If you are considering home financing, it helps to fully understand mortgages. For most of us, mortgages are jammed with difficult terminology and dangerous pitfalls. For the average person, the monthly mortgage payment is either their largest or second-largest expense item.

When you’re shopping for a mortgage, you could easily waste many hours and suffer financial losses by not getting the best loan possible. With the tips below, you can strive to become as knowledgeable as possible before you commit to a particular mortgage.

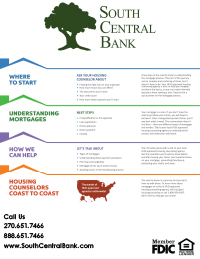

Download our easy-to-understand brochure that breakdown your mortgage and how we can help you walk through the process. CLICK HERE TO DOWNLOAD